open ended investment company vs unit trust

To understand what the best investment option is for you you have to follow the benefits of a closed-ended vs open-ended investment trustsfunds. Unit Investment Trusts UITs are much less popular and only have.

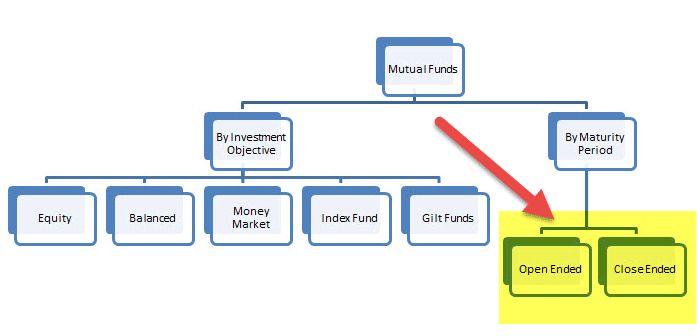

Open Ended Vs Closed Ended Mutual Funds Top 14 Differences

The AJ Bell Fund and Investment Trust Awards is your chance to vote for your pick of active and passive funds in 15 award categories.

. Provides unitholders with a fixed entitlement to income. Unit trusts are also. The frequently cited difference between close and open ended funds is cost.

This is because they do not have to sell assets when investors sell their shares. The primary differences between the two types of investment vehicles are discussed below. One reason is that investment trusts allow managers to take a longer-term view.

Unit investment trusts UITs and mutual funds are both baskets of stocks bonds and other securities that pool investors finances. The two mainly differ in the way they are priced. It therefore creates and cancels shares rather than units.

Unit trusts and Open Ended Investment Companies OEICs are collective investment schemes where investors purchase units or shares in a pooled fund which is run by. The Trusts assets can be almost anything. Securities within the fund can be bought and sold at any time.

An open-ended fund allows for new contributions and withdrawals to and from the pool. And is eligible for the 50 CGT discount. Product Structure The largest difference between the two investment.

Like OEICs unit trusts consist of a manager who buys stocks and bonds for holders of a fund in an open-ended format. There are three main types of investment fund companies. They are open-ended because the number of shares can be unlimited although the price will always reflect the net asset value NAV of the underlying assets.

Unit trusts are open-ended and are divided into units with different prices. As can be seen from the table below investment trust total expenses ratios TERs tend to be. On the other hand the main advantages of a unit trust are that it.

A Unit Trust allows individuals to buy units of a collective investment spreading the risk across a portfolio of pooled assets. The major difference is in pricing as unit trusts quote a bid price to redeem and an offer price when you buy with a spread that aims to ensure new or redeeming investors dont dilute the. But while they differ slightly in structure and.

Conversely when investors redeem sell their units the fund manager sells some underlying assets which reduces the overall value of the fund usually only by a tiny amount. What are open-ended investment companies. The key difference is pricing The major difference is that unit trusts quote a bid price to redeem and an offer price when you buy with a spread that aims to ensure new or redeeming.

Research published in 2019 by the stockbroker AJ Bell found that over the long term 10 years or more 75 of investment trusts outperformed open-ended funds investing in similar assets. Investment in a unit trust also involves buying a proportion of the total fund the unit you are given when you invest in the fund while an OEIC involves buying an actual share in the. UITs are trust funds with a set number of.

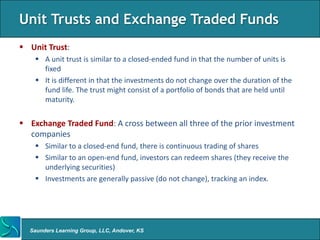

According to Canaccord Genuity there are 51 examples of open-ended funds and investment companies run by the same manager with a similar mandate. In this case the term investment company refers to a company that pools investors money to. Open-end funds closed-end funds and unit investment trusts.

Unit trusts are open-ended funds which means that new units are created as fresh money flows into each fund. Open-ended investment companies Oeics operate in a similar way to unit trusts except that the fund is actually run as a company. Investors pay no commissions to bu See more.

Unit investment trusts are one of the main types of investment companies.

/mutual_funds_paper-5bfc2f4b46e0fb00260bd35d.jpg)

Closed End Vs Open End Investments What S The Difference

Difference Between Open Ended Funds Vs Close Ended Funds

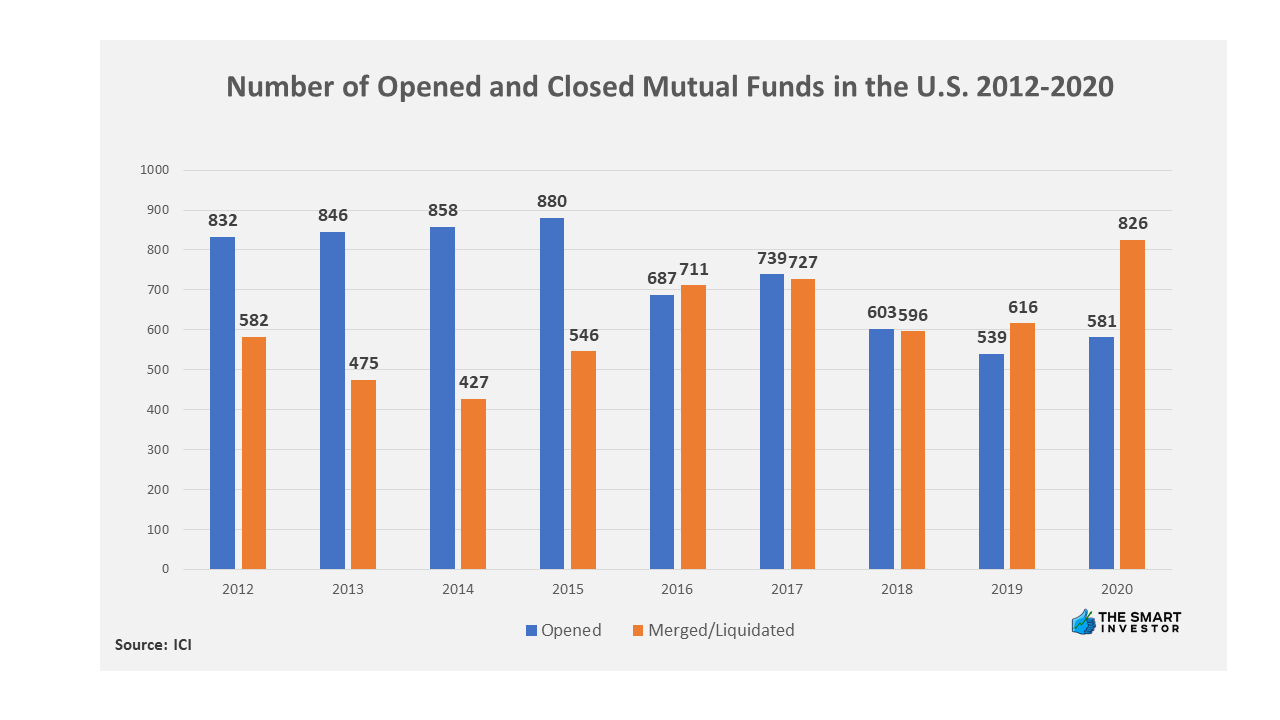

2022 Investment Company Fact Book

Open Ended Fund Definition Example Pros And Cons

Closed Vs Open End Funds Similarities Differences The Smart Investor

Open Ended Vs Closed Ended Mutual Funds Top 14 Differences

The Areas Where Investment Trusts Beat Their Open Ended Rivals In 2020 Trustnet

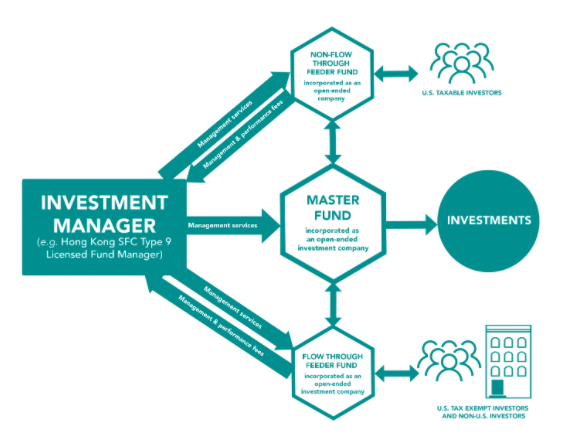

Successfully Launching An Open End Fund Sadis Goldberg Llp

The Difference Between Unit Investment Trusts Uit To Mutual Funds Youtube

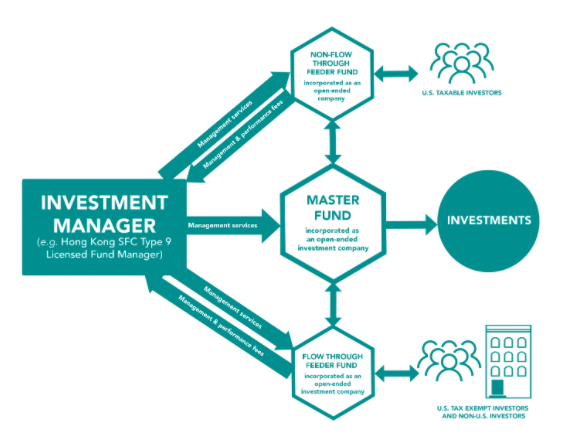

How To Start A Hedge Fund In Hong Kong A Legal Guide Lexology

Unit Investment Trust Uit Definition

How To Switch Mutual Funds From One Fund To A Fund Of Another Company

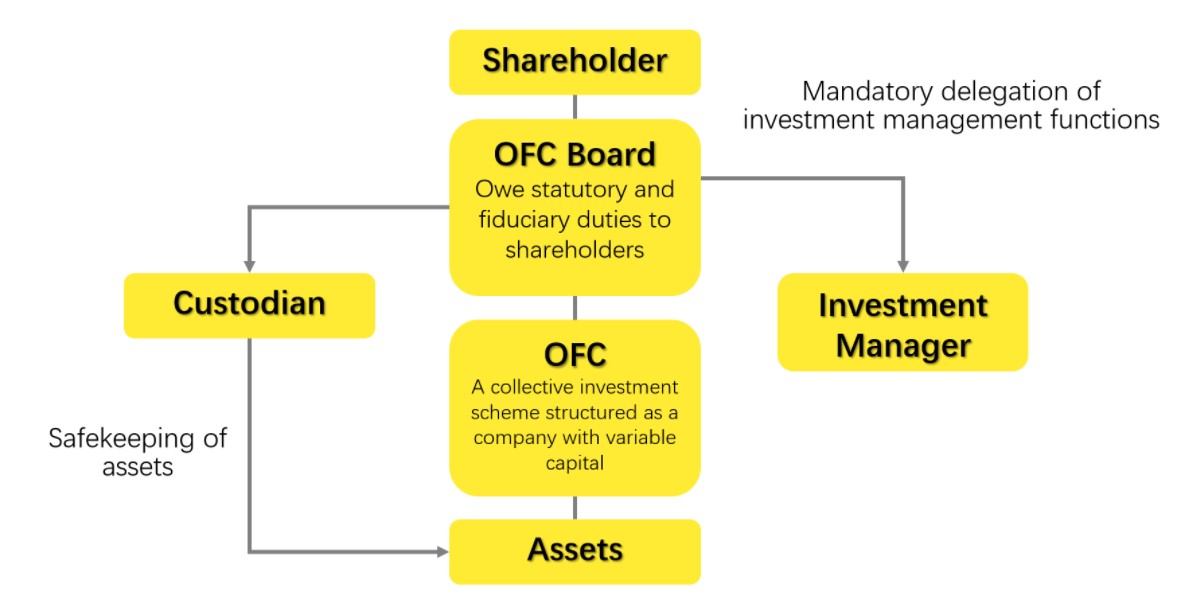

Open Ended Fund Companies Regime In Hong Kong Lexology

Open Vs Closed End Real Estate Funds How The Choice Mattered Msci

The Problem With Investing In Open Ended Life Settlement Funds Colva Capital

Income Lab Ideas Closed End Funds Vs Open End Funds Seeking Alpha